How to Be Debt-Free in 2013

By Stacy Myers, Contributing Writer

Some of you clicked on this post out of sheer curiosity…you want to see what this kook has to say. After all, it’s not something you really believe. You don’t REALLY think it’s possible to live free from the bondage of debt.

Some of you clicked on this post because your heart’s desire is to live debt free – but you’re not there…you want to know how to get there and you need encouragement. You need to hear from someone who is on the other side – someone who is FREE.

And then some of you clicked on this post because you already live debt free. You know what a blessing it is, and so you’ve come here to commune with a like-minded kook. Welcome, all debt-free kooks!

Today I want to tell you that it really is possible to live debt free. It IS possible to not have a car payment. It IS possible to own your home. It IS possible to rent a car without a credit card. It IS possible to use your credit card at Chick-Fil-A, but why should you when you can pay cash. It IS possible to go three days straight and only eat chocolate. Oh, wait. Nevermind. *Cough*

First, a little bit about me – I want you to know that I do know a bit about this topic…unlike some people who write about things but they’ve never lived it: like men who write books about pregnancy and birth – what is THAT about?

When my husband and I got married, we knew we wanted to live debt free. We worked hard at paying off our car (our last car payment!) and then we purchased a townhouse – which we knew we could pay off quickly. We were debt free, including our home, before I was 30 years old. We never looked back.

We were able to purchase a home with cash, which is mostly unheard of. We drive two paid-for cars – not the prettiest things ever, but they function – and when you OWN them, they look a lot nicer. 😉

We even made our own funny music video about being debt-free! And guess what? You can be debt-free, too! It’s TRUE! Here’s how to break free from the bondage of debt:

1. Decide to be debt-free.

It’s hard to get anywhere if you don’t have the mindset that you CAN be debt free. Believe it. Pray it. Then, start living it.

2. Make a budget and stick with it.

It’s hard to be debt free without a budget. You don’t know where your money is going and you can’t tell it where to go…it just ends up at JC Penney or Amazon. If you need help setting up your budget, check out the forms in my husband’s free eBook on how to set up a budget.

3. Attack your debt with a vengeance.

Use the debt snowball. Start paying off your smallest bill and then work up. It’s nice to see the smaller ones disappear. It gives you motivation.

4. Cut expenses and get extra work.

This is the hardest one for most people. They don’t want to cut out things…they hold tight onto what they HAVE. But folks, you can’t take it with you. If you love something, set it free. Ha! One day you can afford it again. Bye-bye, cable television and eating out three days a week.

Extra work is easy to pick up! Baby sit, clean houses, bake for people, set up an Etsy shop, or help with someone’s hit-list. TOTALLY KIDDING on that last one!

5. Make a phone call.

When you have the money ready to pay off a bill, call and ask if you can have a discount – for real, dawg. A lot of the time, they’ll knock off interest or other various fees. When we got the bill from the hospital for both of our children, when we called to pay it, they gave us 20% off because we paid cash.

6. Stay encouraged.

It’s easy to get discouraged if you have a lot of debt to pay off. It can feel like you’ll NEVER be done. When you need encouragement, just stop and look back and where you WERE. You’re not there anymore. You’re breaking free.

I’ve seen it many times, that when someone gets FOCUSED to pay off debt, the Lord blesses their efforts: they get a raise, find extra work, etc. Often you’ll find that you pay off your debt quicker. You CAN pay your debt off in 2013 or at least get a really good start at it…you CAN.

7. When you’re debt-free, bless others.

This is what the Word calls us to do. We have been given blessings, so that we can give it to those in need. And THAT is why Barry and I live debt free.

You can, too – we’ll be there waiting for you…on the other side. 🙂

“Charge them that are rich in this world, that they be not highminded, nor trust in uncertain riches, but in the living God, who giveth us richly all things to enjoy; That they do good, that they be rich in good works, ready to distribute, willing to communicate; Laying up in store for themselves a good foundation against the time to come, that they may lay hold on eternal life.” I Timothy 6:17-19

Stephanie’s note: Stacy’s just being bashful, but her husband Barry is a financial counselor and he has fantastic book called From Debtor to Better, which will show you step by step how to start your own journey of getting out of debt as quickly as possible, just like Barry and Stacy did! For what it’s worth, my husband and I also followed steps just like these ones to get out of $30,000 of debt in the early years of marriage. If we could do this, you can, too!

We took Financial Peace University back in 2006. We’ve made great strides, but we still have a long way to go. The biggest benefit we’ve seen to paying off debt is that when the economy took a nose dive, we were still okay and used to living on a tight budget already so we didn’t notice as much as other people. Since we started the journey, God has added 5 more children to our family and we are still able to pay off debt! We only have about $70,000 more to go which is great considering we started off with just under $175,000 in debt! We go without new vehicles, cable tv, smart phones, high speed internet, eating whatever we want, etc. so that we can hopefully reach our goal in the next five years. We sell things often and my husband has a second job (my job is to keep the food budget low and still feed all 11 of us!).

Darcy, I tried commenting earlier and now it’s not showing up…so if you see this twice, I apologize. 🙂 Congrats on your strides! You’re doing great! And proving to others that you CAN have a large family and pay off debt at the same time! 🙂 Wooooooooo!!!!

I try calling a creditor and getting some of the cost knocked off if I payed the rest in cash. Guess what? They would have to report the part they knocked off to the IRS & then I would have to pay taxes on it.

I’ll assume we can agree that you should repay your debts and this is for those instances when you’re trying to save money on interest and the like. 🙂

There are some instances where the IRS will be notified and you will have to pay taxes on debt forgiveness. For specific details on this process, the IRS has created a wildly confusing and complex guide (http://www.irs.gov/pub/irs-pdf/p4681.pdf). The general rule is this: if you have debt that is “settled” (a true debt settlement) or “forgiven,” the company that forgave the debt may issue you a 1099-C. Debt forgiveness (with LOTS of exceptions) is treated as income by the government. So for example, if you have $50,000 taxable income in 2012 and had a $5,000 credit card debt written off, you’d receive a 1099-C from the creditor and the IRS would tax you on it, making you have to pay taxes on $55,000 “income” instead of $50,000. That being said, I would much rather pay taxes on $5,000 than have to pay the $5,000, considering tax rates for most Americans is less than 30%.

What I’m really getting at in my post is asking for discounts. If you call a creditor and ask them to waive late fees or some interest, that isn’t going to be something that is “income” to you, but it saved you some money simply by making a phone call. Similarly, a lot of companies have a policy that if you pay a bill in full and/or pay with cash they will give you a discount. This is similar to business terms that offer a discount for early payment (2/10, net 30 for example). That’s what I’m suggesting. Make a phone call when you’re ready to pay off a bill and in my experience you can save some money the majority of the time just by asking for a discount.

GREAT motivating article Stacy! We only owe on our home, but are aiming toward getting that paid off. This is a good reminder to “keep the course.” Loved your story. If you can do it…we can too.

Wow! That’s FABULOUS!!!! 🙂 Congratulations to you and your family….kick that debt out, girl.

Excellent article, Stacy! I’ll be sharing this important information! We worked hard to get rid of a lot of our debt so I could come home and be a full-time homemaker. We’re still working on getting the house paid off – motivated to do it sooner than later since we can’t believe our oldest will be going off to college in just six years! Appreciate your advice. The eBook sounds like such a great resource! I LOVE that you close with the real reason – most important reason – for living debt-free, so you can use what the Lord has given to you to be a blessing to others. We know that everything we have is from Him and what better way to be a good steward and further His Kingdom than to ensure you are using your first fruits to glory God. Many blessings and thanks for this inspiring article! 🙂 Kelly

YES!!! We live debt free so we can GIVE! 🙂 And giving when you’re free from bondage is just the most wonderful feeling ever. To God be the glory!

What an inspirational article. I am especially impressed by the pic with Dave Ramsey! I’d frame that and hang it!! 🙂

Here is my question. What reasons would you give for acquiring more work to a couple who has young children and an already-busy lifestyle? We’ve already cut (and cut) unnecessary expenses, and the only debt remaining is the home. But my husband is gone enough (I think!), and I am stressed enough (I think!). Do you still think it’s worth it for a family like us to take on more work to eliminate house debt? Or would it just be a slower path? Anyways, thanks for being “that couple” who inspires the rest of us that something different is possible!

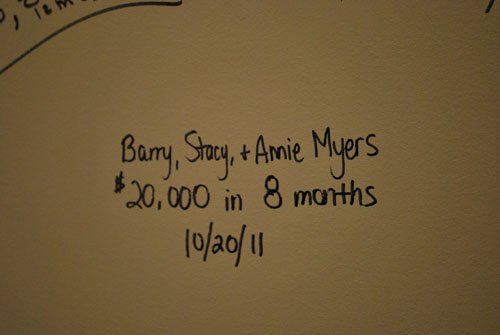

Jessica, when our house was the only debt remaining at $20,000, we decided that we wanted to be done. We knew we could do it in less than 1 year, so we worked hard at it. For the most part, it didn’t take us away from our family (I made money on the blog and at workshops where I took Annie with me; Barry made money designing websites – stuff he did at home with us). Because it was only 1 year and I knew Annie would be with me, even with the extra work, I did it. Would I have done it if it would take me away from my kids and my husband for long amount of time for an extended period? Probably not. Time is too precious. I think maybe our case was different because we wanted to sell the townhouse and buy a REAL house for our kids to be raised in.

If you intend to live in your current house for a long time, I wouldn’t forgo time with my kids to pay it off uuber fast. I’d just do whatever I could to make extra money and take it out fastER.

Does that make any sense at all or am I just blabbering? LOL

I’m in a similar situation- I’d say you don’t get these years back with your kids. We’re working at the debt but slower paced because of the kids and me being home with them.

We’re paying off debt too but not as fast as we’d like either because I am home with the kids and my husband already works hard hours. He doesn’t want to be away from them more either.

My husband and I are consumer debt free, owing a mortgage on a 7 year old home that we plan to pay off in less than 2 years! We run our business debt-free as well. This has given us such peace during these harder economic times for our industry. Our 2 children will graduate from college (daughter working on degrees 2 & 3 will graduate Dec. 2013, son will graduate in Dec. 2014)debt-free, already financially ahead of many of their peers. We have taught them to save for the things they want (they put at least 15% of all earnings and monetary gifts in savings) and to live truthfully (not spending more than you earn). They will reap the many financial peace benefits of the seeds we have sown.

A debt-free business?! WOOHOO!!!!! 🙂

I think the biggest thing is to start early. It’s easier to just buckle down and get it DONE before the kids come along, or while they are still young.

Then that’s the only life they know – it’s how my parents raised me and I am SO thankful!

We believe in living without debt too, but have a problem when it comes to housing. We have to live in a high cost of living area and “bought” a house because even at 500k the payments were a lot less than renting. We thought we were doing well just to get the20% down in cash, which has kept us from going upside down. Now with low interest, we have the option of refinancing into a 15 year, with higher payments but a lot of total interest savings. This would make things tight for a looonnngg time of course make is more vulnerable to income changes but we would get it paid off in half the time. What would you do?

I asked Barry and he said: My general rule of thumb is you need to save at least 1% on your current APR to even consider a refinance. That being said, you’re right that a 15-year note is better because it is always going to pay off in 15. If you’re already in a 30-year loan and can’t save significantly by refinancing, I would stick with the 30-year loan and make the commitment to ALWAYS pay as much extra as possible. This is a discipline issue, but you can do it!

I’m always encouraged to read of others who have chosen to live within and below their means. The most important step in getting out of debt is to STOP DIGGING A DEEPER HOLE! If you are consistently spending more than you earn, make whatever changes are necessary to reverse that and spend LESS than you earn.

You will have to make sacrifices in order to do this, but the peace of mind of being debt free is worth it.

You’re right – the sacrifice is worth it. 🙂 And really, when it becomes a way of life, it seems less like a sacrifice…and more like “normal”.

Budget and pay cash for everything…it really works!! That’s my recent experience to share. It’s exciting (and frightening) to see how much money is saved (and was wasted) by doing just these two things! 🙂 Blessings to you Stacy. May the LORD bless your family in 2013…HE is Good!

In HIM,

Camille

To God be the glory! 🙂 I <3 my budget.

Just a note from a different situation. We were debt free except for our mortgage 2 years ago. God called us to move across country to help with a church plant. We have been here for 6 months and our home is still on the market. So we are now incurring debt we would not have if we had not obeyed and moved – medical bills that we normally would pay in full, etc, can’t right now because we have a mortgage on top of our rent. SO I just wanted to say that sometimes God’s plan and timing is not the same as ours. We still desire to live debt free, but obeying God was more important than controlling our financial situation. I totally agree that God blesses those who are good stewards of what He gives. But I have learned that our ways are not His ways, and He may have a different plan or timeline than what we have. AND God shows us that He will provide for our needs when we aren’t sure how ends are going to meet.

We have still learned many valuable lessons and are not giving up on becoming debt free…it just isn’t going to be as quickly as we thought!

We live by and teach that Romans 13:8 is the Christian approach to debt – it says (summarily), “owe no man anything except the continuing debt to love one another.” My husband worked for six years at a credit card company, primarily focused on collections. This clearly was not his passion but God had plans for him to gain that knowledge to be able to share with others. Maybe your debt is for this same type of purpose.

Great article. We started Dave Ramsey’s program in late October and have since built an emergency fund, paid off one credit card and are $700 away from paying off another. It is amazing….and did mention has helped our marriage? I honestly think that is what is the greatest:)

Amazing!!! Keep up that awesome work, girl!

You’ve gotta just…do it. Ask yourself “Do I really need…?” (TV, internet access, a cell phone, etc.) and if not…get rid of it. Buy cheap food (but good food — local farms are your friend). Buy cheap clothes (Good Will!). Buy used cars, or don’t buy a car at all. We made very little money when we got married and we had a lot of debt. But we paid off the biggest chunk in that first year despite that we didn’t make much money! It snowballed from there and we do still have a mortgage on our home, with a plan to pay it off in the next few years. We just re-financed for a lower interest rate and are putting the extra money on the principle. Everything else was paid off a couple years ago, and we even saved up money to buy a new furnace and a new van with cash. We are saving up again to buy another “new” car (probably one that is 3 – 5 years old, just new to us) in a year or so. We also have a large emergency fund so that if anything happens…we’re covered. No need for credit cards. There are 5 of us now, soon to be 6. We buy a LOT less “stuff” than most do…but I’m looking forward to the day when we’re totally debt-free and we save up money and get to take awesome vacations and do other fun stuff, because we sacrificed for so many years. How much we will enjoy being able to do those things, knowing we worked hard to EARN them!

Buying a lot less “stuff” is a perk to me, as I’m sure it is to you….when your family grows, there is less room for “stuff” hanging around. Great comment, Kate! I Thanks for sharing your story!

I find these posts both encouraging and discouraging at the same time. My husband and I have always been very frugal, but we have significant student loan debt, for which the total is still more than he makes in a year. We feel constantly wedged in one of those spots where getting extra jobs would cost us money in childcare and therefore negate itself. We use our entire tax return every year to pay off student loans but at our current rate it would take another 30 years to pay it off. (Our repayment plan is set up in such a way that you can’t make extra principle payments unless you are paying off a whole loan). I admire those who are able to pay off $20,000 in a year. If I had free childcare and I returned to the workforce fulltime, we might pay off my husband’s student loans in two or three years, but I would also be missing those wonderful early years of my children’s lives. (We have a three year old and a 9 month old). It’s hard to be lumped into a category of “people in deep debt” when all we have is student loans and a mortgage on a tiny little house because it feels like we didn’t do anything “wrong” but we get judged all the time. If it weren’t for student loans we would be living comfortably right now with some margin in our lives. Instead, we constantly struggle.

I can sympathize some, as we have struggled due to student loans as well, and I am at home full time with my children (3 of them). I only had my husband’s loans to worry about though. I say, just do what you can at a slower pace, as I do NOT think its better to pay off the debt faster and not be at home with your children. I realize that is controversial, but I am going to say it anyways. You will never get these years back with your children. Yes, work on debt, but make sure you don’t give up these years in the pursuit of the debt free life.

Everyone has a different pace based on the situation they find themselves in. Really, it’s about a mindset change; being uncomfortable with the idea of living in debt, and not incurring any more. It sounds like you are working well toward being debt free. Be encouraged! 🙂 When you get down, just look back at where you were and how far you’ve come….you’ve come a long way, baby.

And if you ever need help or advice, you can just holler at Barry. That’s what we’re here for.

Bethany!! Don’t stress! You CAN be amazed at this accomplishment. My husband and I have spent the last 10 years paying of multiple credit cards, law school loans, mortgages, cars, and back charges that were harming our credit score. There have been times of quick pace and slow pace as we changed jobs, living situations, and especially when I quit my practice four years ago to stay home full time. In the beginning, the goal of living debt-free looked ridiculous because the hole was so deep, and the possible contributions so small. Whenever we read success stories they seemed to be from people much younger, or with much less debt, or with double income-earners. And our culture does not exactly applaud this goal or the decisions we have made each month to meet it! We have made mistakes like taking on more debt, overspending, poorly budgeting. We have struggled through discouragement and celebrated joint accomplishment. But overall things kept trending toward the goal. Now, Lord willing, we are in two-years striking range to be completely out of debt beside one manageable mortgage, at which point we intend to sell and reevaluate based on the principles we’ve learned and acquired on this journey. We are really, really desirous of meeting this goal and we give only God the glory for the fact that it may be in sight. However I will say that even if circumstances prevent us from the accomplishment, the process has been completely worth it for how it has blessed our relationship. We are the only couple we know that doesn’t fight about money, and we have a special closeness because the Lord has used this time to teach us better (NOT perfect!) priorities. Even in our many mistakes and compromises he has humbled us and taught us graciousness for each other. I would not let anything discourage you from doing what you can, and being at peace with the process. I obviously can’t say enough about it since this is probably the longest comment I’ve ever left on a blog! 🙂

This is great, we’re working on our debt too, we have $13,000 left (I don’t remember exactly all we had…it was in the $40,000 range at one point). We are hoping to have that done in about a year and then saving up for our emergency fund, then a down payment, as we are back to renting these days with our move.

I just wish housing prices were cheaper, and that renting was cheaper where I live now. WOW its really expensive. We keep looking at our budget and wondering where to squeeze more out of it but its just not possible. Sometimes I wish I could do something to “earn” a bit of money to help make it faster but my days are full with my 3 kids and being home full time and my husband already works a lot so we’re just doing it at a pace we can.

Thanks for sharing!

That’s awesome Nola! My husband and I are going to seriously start working on being debt free in 2013! We have found a way to earn extra income and we would like to share it with you if your interested. It can be worked around family, kids and jobs!

Everyone’s pace is different based on situations…but I can tell you have a heart to be debt-free, and you also have the gumption – and that’s really what it’s all about. It’s a mindset – and you have it girl. 🙂 Thanks for all your great comments.

Thank you for this post… we have moved 4 times this year…but that is another stroy. Anyway, we have been working on our debt steadily for the past 2 years. It is a slow process as work issues, health issues have come up and exhausted our funds. But that is what they are there for ememrgancies. So, just here to say, we are still at it. rebuilding our emergancy fund, and paying down our LAST loan, ($10,000) At our current plan we will be done with this bill next year.

So, long story short, I am thankful for this post as a reminder of what we are persuing. Because as something goes out on the truck and we have to pay for one more thing, it is soooo tempting to just trade it in and reload ourselves with debt. So, not a good idea.

Vehicles drive so much better when there are no payments. 🙂 Don’t you agree? Congratulations on the road to freedom! You’re so close!

I liked this article alot. I admit that I am going through a bankruptcy right now and after this, I will still have the mortgage and student loan debt to pay. I am currently working the plan of getting an emergency fund and then the 6 months of living expenses and then snowballing the student loan debt. I think going through all of this financial mess that I made has been the worst and best education that I could have. My mind set has changed from consuming and acquiring things to the focus of being a good servant and stewart of what God has blessed me with. I have learned how to cook, garden and craft items to help save money. My husband and I spend more time together and our lives are less “noisy” with distractions.

🙂 Experience is the best teacher…and just think: now you’ll be able to help and encourage those who are going through the same experience. What a blessing that will be!

Such an encouraging post, thanks for sharing. I had a small break in my debts last month which encouraged me to step it up some more. If all goes well i’ll be debt free by the end of 2013! Yay! And you are so right, bless others when you have freedom. It’s so great already to have more financial space to help others and less worry so i’m more open to the needs of other people. However i do feel i’m in a better position now to teach our children about money. I’ve seen the ugly side of it but managed to get out of it. Hopefully this will help me instil a better sense of money in the kids then i ever had!

As Dave says, you’re changing your family tree! You go, girl. 🙂

What a great post! And great picture with Dave, too.

I am debt-free. I am the only one in my family who knows how to handle money. I am 50, and all my life I wanted to get a handle on finances. I tried over and over again, with different credit couneling services and Christian agencies, some of them were even very good ones such as Larry Burkett’s before he merged with Crown, to learn how to budget and how to get a grip. I tried and failed over and over again. I kept failing but I kept being determined to succeed. If you’ve ever been an utter failure at something in your life, but refuse to give up even though you have to bow out of the picture for awhile, and then you always end up coming back to it later because you are DETERMINED to get this, then you know what I mean.

I went to a free Crown “opening seminar” about their program (another attempt), and *coincidence coincidence* the man sitting next to me casually mentioned in passing, a name I had never heard of before: who is this Dave Ramsey guy? On the drive home I was flipping thru radio channels trying to find something worth listening to on a Saturday afternoon, and *coincidence coincidence* for the first time I heard Dave Ramsey.

Now THAT had my attention.

But it wasn’t enough. Everyone is different, but for me, I had to go to Financial Peace University (FPU) to become debt free. Wanting all your life to know how to handle money, and having zero knowledge and having to learn everything from the ground up, are two different things. In Fall 2004 I went to FPU, and in Spring 2006 I was debt free.

I am still debt free, have no credit card in my name, and yes I still rent cars. My car is paid for. More importantly, when there is a setback in your life, you have the framework and the WORKING knowledge to know how to get back on track.

I will be forever grateful to God for sending me the gift of Dave Ramsey.

If you REALLY want it, then, NO EXCUSES. Get your butt over to FPU. You CAN do this. And you will NEVER be sorry you became debt free.

🙂 I love how you put “coincidence” in quotes. Thank you so much for sharing your story – I know it will be an encouragement to others along their path!

Stacy,

Thanks for being my inspiration for this new year! I am going to do what it takes to be debt free so that I do not have to work full time and can focus more on my family and house:)

Family – that’s what it’s all about! 🙂 Blessings to you and your family in the New Year!

My husband and I have been married for just over 2 years – we had a pretty significant amount of debt when we got married – I buckled down and now all we owe is our house- which if a fair amount b/c house prices where we are are not like the US…

We would like it if I could stay home when we have children so I am going to get on making a budget!! Thanks for all the tips etc..and HAPPY NEW YEAR!!

Woooo! Making a budget is rough until you get the hang of it – then it’s a breeze…and it’s a great way to start getting out of debt!

Thank you for this post! I’ve never really had to question where money was going to come from before. Even when I was married, we always made enough to live frugally and put in savings. Now my husband has left and after two hospital visits, I am in debt and having to find a job (I’ve been a stay at home mom for a few years) to support my family. It’s really making me take another look at finances! I’m hoping I can be debt free (with the exception of my home) by the end of 2013!! Thank you for the inspiration! (Looks like I’ll need to check out what Dave Ramsey says too…)

Yes! He is a great resource! You can find all sorts of great info on his website. 🙂

What a GREAT video! Found your blog a couple days ago through Pinterest and I just LOVE it!!! Thanks so much for posting. I, myself am just starting down the soon-to-be DEBT FREE road. 🙂 I am single and learned from a young age to NOT use credit cards, but one day I let my guards down and that was it – downhill fast! And then recently broke my record of NO car debt for 8 years, when my I HAD to purchase a car and didn’t have the money saved. But with that said – I am truly optimistic that I can over come this! There is a financial freedom class starting soon at my church, I’m seriously thinking of going! Additional knowledge and accountability can’t hurt, right? 🙂 Thanks again for your site!!

We had a lot of fun with that video! I am glad you enjoyed it. 🙂 I still sing it!

I’m really greatful to have found this site. I really enjoy your posts. This being debt free in 2013 came ata great time. I’ve never been very good at budgeting, I’ve tried taking classes andgetting some help only to fall on my face. I feel like I’m back where I said I would never go again, after having gotten out of debt. I feel that your book and other helps here will really make a difference this time. I feel that finding you is an answer to prayer. I am trying to learn to make more of my own things than buy even more than before. I’m greatful that you are here and that you are willing to share your knowledge and support with me and others.

Well, a budget is a great place to start! If you need any help setting it up, or have any questions about the books, just give us a holler. Okay? 🙂 Blessings!

While I find the debt free concept compelling, I find it more than a little ironic that the download must be paid for with a credit card.

🙂 Well, we don’t really have a say-so over what PayPal accepts. That’s their policy and not ours. You can just as easily use your bank card. 😉 Our PayPal account is directly tied to our checking account – we don’t even own a credit card.

I found Dave Ramsey a couple of years ago. His Financial Peace program saved our family finances and taught all of us about what is really important in life. Stuff just wasn’t needed to make us happy. Really, really enjoy your blog and posts on Facebook. If you ever have a need for herbal info such as growing and using of my favorite plants, please let me know. Thanks.

I’m so glad to hear that! Dave has such a fabulous ministry! 🙂

Great tips. My husband and I are serious about paying off debt as well.

Curious… how much are house prices where you live? Houses in Vancouver cost an obscene amount of money so we choose to live in the burbs where you can get a fixer upper for a mere 600K. Imagine interest payments alone on a 550K loan and repairing your leaky roof.

We purchased our foreclosed home for $93,500. It was a steal. If you have the opportunity to look at foreclosed homes there, I would highly recommend it! 🙂

Hey Stacy! Just wanted to let you know that I bought your husband’s book yesterday and finished it today!! I’m so glad that I did! I’m very motivated and exctied to start on the path to being debt free. Thanks for posting this blog, and for mentioning your husbands book! Take care!

Stacey

Great! 🙂 If you have any questions, just shoot them on over.

We’ve been doing our debt snowball for several years and are on track to be debt-free (except the mortgage) this July. I can’t wait! Whenever I feel discouraged, I look at the numbers we started with or listen to Dave’s podcast and hear how others have achieved. It’s so inspiring!

We love listening to Dave on the radio! 🙂

Thanks for sharing. We’ll be debt free including our mortgage on August 23, 2013. It’s not an easy road but the feeling is great to see those numbers go down each pay day.

That is AWESOME!!! Now you’re weird too! 🙂 Welcome to the club!

I really enjoyed reading this article. So many people are trying to become debt free. So many people are trying to just have the income to pay their normal day to day bills. I too was living check to check and decided that I needed to make more in order to pay off my debt. I then decided to start my own work from home travel business. I still have a full time job. I just take the money made from my business to pay off debt. It works out great and I am also able to take advantage of tax breaks with my home based business. It is a win win situation. Thanks for providing hope to those who may not think it is possible!

YES! That’s how we paid off our debt – putting ALL EXTRA towards it and kicking it to the curb. 🙂

First off let me start by saying that I really enjoyed reading your post. LOL the chocolate comment was too funny. I love your bubbly personally and fun sense of humor.

Now to respond to the topic. I have always lived my life by the motto if you can’t pay cash for it then you don’t need it. Don’t know why I am that way because it was not the way I was raised. I am very frugal and a lot of people confuse me with being cheap. The way I live is off the bare minimums of life. The only expense I splurge on is my Internet service, I call it my second brain. Plus I have the luxury of working from home so the Internet is needed. I am saving a lot of gas money. So that balance things out, Internet versus gas. Other than that I just have the basic utilities. No cable or cell phone bill.

Being a single parent I don’t think I have done too bad. I paid off my only credit card 6 years ago and the only reason I used a credit card was because the engine went out in the vehicle I had so I had to purchase another one. The car was under $10K so it was a financing issue. Can’t remember all the details, just remember using my credit card. LOL a lot of people were amazed that I had that kind of balance on a card. Anyway, I paid that puppy off quick because I HATE credit cards with a passion.

I bought my first house when I was 19 and sold it when I was 26. With the money I made from the sell I paid cash for a nicer vehicle and I moved into an apartment until I decided where I wanted to live. Finally after two years of apartment living I got tired of giving my money away so I started looking for a home. Found a 9 year old home in a Short Sale situation for only $105,000. That was really cheap compared to some of the mold infested homes I looked at and they wanted more money. But at the same time for a single mom it was not the cheapest. My first house was a nice little starter home and I got it for only $42,000. The house was in really good shape, don’t know why it was so cheap but I took it. Maybe because it was only 800 sq ft.

Anyway, now that I have been in my current home for almost 4 years I have decided to get this house paid off ASAP. I am to the point in life where I am tired of being bound to a job. I am tired of hearing how people are getting fired or living pay check to pay check. I don’t want those worries anymore. I want to be free to do whatever I want. Right now I feel like I am a slave to my job :-(. I have always used my Tax Refund and applied it to the principal of my mortgage but now I have started getting really aggressive with this deal. Not only am I doing the Tax Refund thing, I am also doubling up on the mortgage. If I keep this up, then I should have my house paid for in the next 6 years or less. I would totally have my mortgage paid off after only 10 years. That would be a total victory for me. I can’t wait until that day. My daughter keeps telling me that 6 years is a long time but I have to remind her that 6 years sure beats the 26 years I am suppose to pay off my mortgage. I really Envy married couples who have two incomes. If they are not working together to pay debts off quickly, then they are missing out on their true blessing. FREEDOM!!

The End 🙂

Wow, Pam! You’re kickin’ it girl! LOVE the story! Thanks so much for sharing it here as a testimony to the fact that living debt free is possible! You PAY OFF that house! WAHOO!!!

YIKES!! Can’t believe I wrote all that and I didn’t even say CONGRATULATIONS on being debt-free. Guess I think that everyone can read my mind lol. I am really excited for you and your family. Can’t wait until I am there. My daughter laughs at me because every once in a while I go around the house singing your Debt-free and I Know It song. I like the way that sounds!

🙂 It gets in my head too.

Stacy, Thanks for sharing your journey and thoughts about living debt free. My family has been working for almost 3 1/2 years on our debt free journey and have paid off over $100k so far! We “only” have $15k left to go but do sometimes start to feel like we’ll never get there. I love reading posts about people who’ve made it through to the other side, it’s helps me keep going one more month. I know that the end result of being debt free will be worth it thanks to folks like you sharing their stories.

Stacie, that is AWESOME!!!! You’re killing it girl!

Is definitely IS possible to live debt-free! Thank you for sharing 🙂 When we got married 7 years ago we bought a house, paid half down in cash and had the other half paid off before the year was up. We have not had a debt of any kind since! We have a growing family of 6 (going on 7) and only one-income supporting us and it’s totally doable. It’s the most wonderful way to live 🙂

Thank you for the entertaining encouragement! Our goal is to be debt free by this Christmas, God willing! As of right now, we are on track! 🙂 http://shadesofmay.wordpress.com/2013/07/14/our-new-money-goal/

CONGRATS on becoming debt freeeeeeee! 🙂

YEAH! You can do it! *Fist bump*